“Seeing my mom crying and praying and thanking god that she gets to stay in her home. It puts a smile on my face…. This place really helped her.”

Filing taxes has never been this easy through our revamped File4Free program. We can help you get the money you deserve this tax season.

Certified workshops aimed at enhancing financial literacy and capability, covering topics like budgeting, credit building, and home buying.

Certified counseling services to address both financial and housing challenges like managing debt, improving credit scores, and navigating the complexities of homeownership or rental finances.

No-cost official tax preparation services to low- and moderate-income individuals and families, helping clients maximize refunds and access credits such as the Earned Income Tax Credit (EITC).

Our mission is to provide a safe haven for vulnerable communities, empowering them with no-cost financial education and services that break the cycle of economic hardship for good.

“Seeing my mom crying and praying and thanking god that she gets to stay in her home. It puts a smile on my face…. This place really helped her.”

Chris J.

Former Client

“Haven is a little office that does business in a huge way because they are not saving people’s assets, they’re saving people’s lives”

Barbara C.

Current Client

Stay updated with the latest news and insights from us by subscribing to our newsletter!

Free Virtual Financial Webinar | 4-Week Course

Build Financial Confidence and Long-Term Stability Build the confidence, knowledge, and tools to take control of your financial future through...

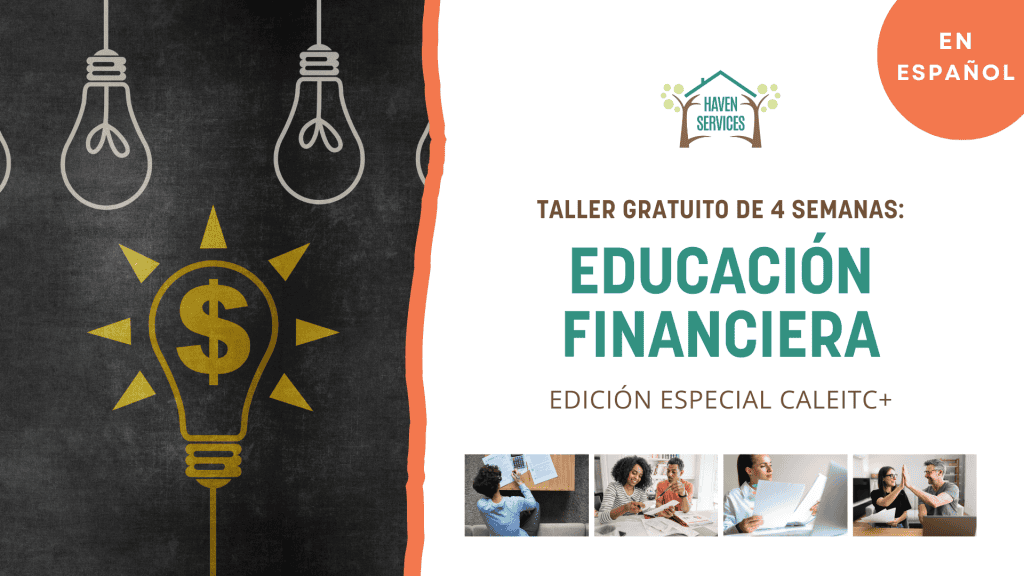

Seminario Virtual Gratuito de Educación Financiera | Curso de 4 Semanas

Desarrolle confianza financiera y estabilidad a largo plazo Desarrolle la confianza, el conocimiento y las herramientas necesarias para tomar control...

Schedule an appointment today to enroll in our FREE Financial and Housing Education Workshop / Counseling programs.